One of the weird but infrequently mentioned quirks of salary negotiations in the NHL is the competing interests of players and owners with regards to how the actual salary payments should be structured. While analysts tend to focus on the AAV when evaluating a deal, the details of how much a player gets in each year are actually critical to understanding how much a team values a player.

For players, there’s a strong incentive to get as much money as soon as you can. Not only does this protect you against a buyout to a certain degree, but because of the time value of money the actual net value of the contract is greater to you the more you front-load your contract. If a player has the choice between a 3-year deal where they’re paid $4M each year, and a 3-year deal where they earn $5M in the first year and $3M in the last year, they should opt for the latter deal, since an extra dollar now is worth more than an extra dollar in the future. The AAV on both deals is the same, but the player comes away with more value if they get their money sooner.

For owners, obviously, the incentive runs the other way – you want to back-load your players’ contracts as much as you can, since you can take any amount you save in year 1, invest it until year N, and then pay the player using the principal while pocketing any interest you’ve earned. But if you insist on pushing salary later in a deal, players may ask for more money in total to compensate, inflating the overall AAV on the contract.

Because of this, it’s not really fair to compare contracts that have the same AAV but different payment structures. If two players have a 6.5M cap hit, but one player is getting more of their money earlier, it likely means that their team believes the player getting paid sooner is more valuable.

While it’s easy enough to compare two deals that have the same cap hit but different payment structures, it gets a bit more difficult when the cap hits, or even the contract lengths, are different. One way we can make a fair comparison, however, is by calculating the net present value (NPV) of a contract, and then using the NPV to figure out what the equivalent cap hit would be, if all the payments were the same amount over the life of the contract.

While this may seem a bit complicated (and perhaps even unnecessary), a simple example shows how this can impact a team’s cap position. In his most recent deal with the Lightning, Steven Stamkos’ signed for an average annual value (cap hit) of $8.5M per year, earn $64M total of the course of the 8 years of the deal. But because of the way it was structured, Stamkos will earn nearly 75% of that over the first 5 years, taking home just $20.5M in the last 3 year seasons. How much money cap hit would he have commanded if the Lightning had insisted on equal payments over the life of the deal?

If we assume a 5% discount rate[1], the total payments on Stamkos’ deal had a net present value of just over $58.5M when he signed the deal. To create an 8-year deal with the same present value and with constant payments each season, you’d need to pay an average of $8.625M per year. Not a huge difference, but that means that the Lightning saved roughly $125K on their cap just by structuring the deal in a manner more friendly to the player. If you’re able to do that for five long term deals, you’ve saved yourself the cost of a whole ELC.

Which players have seen their cap hit reduced the most by structuring? The table below has the 10 deals with the greatest savings from structuring since the July 1st, 2015.

| Player | AAV | Equal Payment AAV | Savings From Structuring |

| Carey Price | $10,500,000 | $10,804,266 | $304,266 |

| Jamie Benn | $9,500,000 | $9,799,430 | $299,430 |

| Anze Kopitar | $10,000,000 | $10,287,619 | $287,619 |

| Brent Burns | $8,000,000 | $8,219,435 | $219,435 |

| Connor McDavid | $12,500,000 | $12,693,446 | $193,446 |

| Brent Seabrook | $6,875,000 | $7,066,703 | $191,703 |

| Ryan O’Reilly | $7,500,000 | $7,666,430 | $166,430 |

| Brad Marchand | $6,125,000 | $6,274,331 | $149,331 |

| Andrew Ladd | $5,500,000 | $5,647,751 | $147,751 |

| Milan Lucic | $6,000,000 | $6,146,556 | $146,556 |

Unsurprisingly, big value deals for longer terms have saved teams the most cap space, but the list of names here also raises a slight problem with the “pay them early strategy”, and that’s the possible increased buyout cost or cap recapture penalties. While ideally a GM’s player evaluation skills are so good that they never run into a scenario where they no longer want a player that they signed to a long term deal, a quick look at the table above shows quite a few names that may be candidates for buyouts in the future.

As such, this buyout/retirement risk needs to be considered alongside any initial cap benefit that you might get from front-loading a deal, and giving front-loaded deals to players past their prime should almost always be avoided as the savings may not be worth the eventual cost.

We can also look at which deals have theoretically left teams with less cap space than they otherwise would have had on a balanced deal.

| Player | AAV | Equal Payment AAV | Cost From Structuring |

| Michael Matheson | $4,875,000 | $4,741,956 | -$133,044 |

| Adam Larsson | $4,166,667 | $4,086,521 | -$80,146 |

| Damon Severson | $4,166,667 | $4,087,939 | -$78,727 |

| Brandon Saad | $6,000,000 | $5,933,451 | -$66,549 |

| Oscar Klefbom | $4,167,000 | $4,103,884 | -$63,116 |

| Aleksander Barkov | $5,900,000 | $5,837,267 | -$62,733 |

| Nathan Mackinnon | $6,300,000 | $6,249,147 | -$50,853 |

| Alexander Wennberg | $4,900,000 | $4,850,978 | -$49,022 |

| Hampus Lindholm | $5,250,000 | $5,206,106 | -$43,894 |

| Vincent Trocheck | $4,750,000 | $4,711,394 | -$38,606 |

There are two things to note here: first, the list of names on here are almost exclusively from clubs that rank towards the bottom of the league in attendance, meaning that these structuring decisions may have been made by ownership rather than the front office.

Second, the magnitude of the “costs” here are much smaller than the savings from front-loading deals. This may reflect the fact that while owners would obviously prefer to push back payments, the people negotiating these deals (GMs and players) often see the same benefit from front-loading them, and so there are simply fewer deals that significantly push money back into later years.

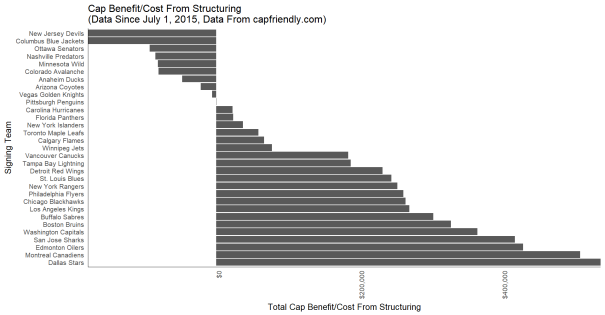

The last thing we can look at is which teams have saved or spent the most cap space on structuring over the last few seasons.

We see a bit of an expected trend here, as most teams have seen a net cap benefit from pushing payments forward, while some of those with weaker finances have actually theoretically paid more to delay some of the cash payments until later. For most teams it doesn’t amount to a significant savings, but some clubs (Dallas, Montreal) have seen more than half-a-million in theoretical savings (although whether they’re really savings is debatable when you consider that they’re locked in with Ben Bishop and Carey Price in net for the 2022-23 season).

While there clearly may be benefits to teams to ensuring they structure their deals properly, how big those benefits are is heavily dependent on the assumptions you make about the discount rate. We’ve used a 5% rate here, but if it’s higher (i.e. good markets) the benefits jump, while in lower growth environments, the benefits of structuring will be muted.

We’ve also significantly over-simplified our analysis here with our handling of signing bonuses. Since signing bonuses are paid out on July 1st of every year, while salaries are paid over the course of the season, they’re actually even more valuable than regular salary to a player. While owners may be hesitant to give out signing bonuses (there’s a risk you pay a significant cost to a player without having them actually play for your team if you trade them before the season starts) they’re a significant way in which teams can offer more value to a player without seeing a corresponding jump in cap hit.

[1] Entirely and completely arbitrary, but probably somewhat reasonable.

[…] this idea that’s been floating around in my head for the last 2 days since I wrote about optimizing contract structure – if GMs could theoretically save cap space by setting up contracts to pay more money to […]